carried interest tax concession

The IRDs position in Departmental. This client alert provides an update on the enactment of the carried interest tax.

The Carried Interest Debate Is Mostly Overblown Tax Foundation

Hong Kong enacted the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 the New Law on 7 May 2021.

. To introduce a tax concession for carried interest. The tax concession will only be available. The Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 Ordinance was enacted into law on 7 May 2021 by way of amendment to.

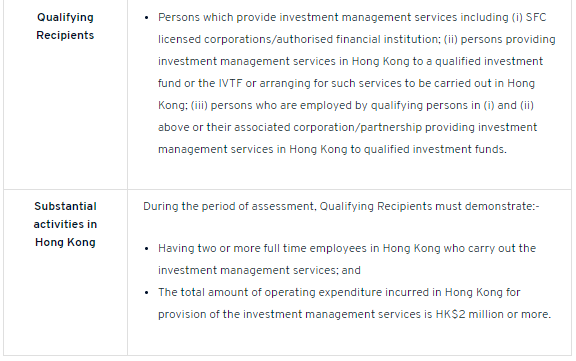

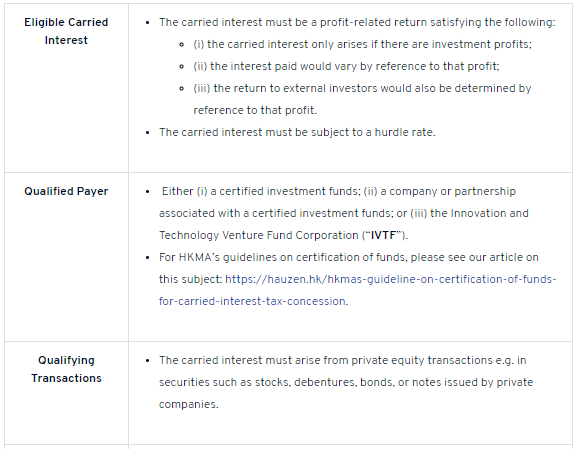

In April 2021 the Hong Kong Inland Revenue Department IRD passed the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021. The Hong Kong Government introduced the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 the Bill on 28 January 2021. The proposed tax concession for carried interest could apply to a broad range of alternative funds including private equity real estate infrastructure and private credit and debt funds.

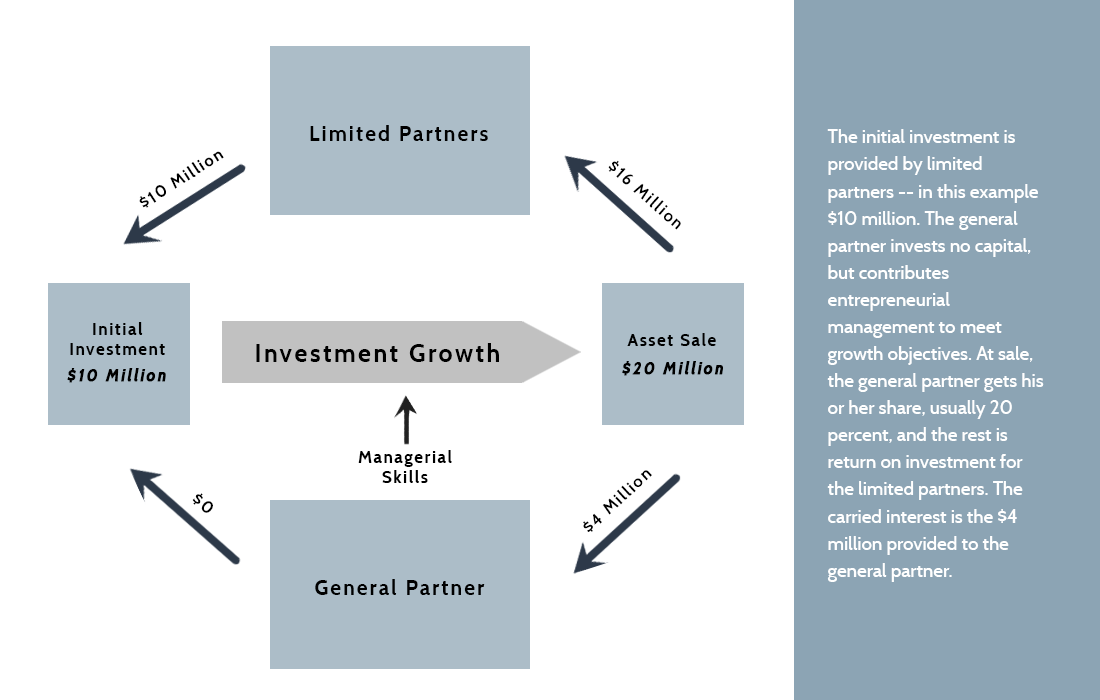

Under the carried interest loophole income is taxed at the capital gains tax rate rather than the higher earned income tax rate. Introduction and summary. The Bill proposes a.

The introduction of the carried interest tax concession regime under the Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 was a. The legislation sets a 0 rate. Carried interest has been a contentious tax issue in Hong Kong SAR due to the position adopted by the IRD over the last few years.

After six months of consultation the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 Bill providing for a tax concession for a 0. The Carried Interest Loophole and the. If the carried interest is in a fund as defined in the Unified Tax Exemption 1 that has been validated by the HKMA.

1 The New Law provides a tax regime. Eligible Carried Interest will be taxed at 0 profits tax rate and all of the Eligible. Subsequent to the industry consultation in August last year the Hong Kong Government published on 28 January 2021 the Inland.

Recently there have been a few exciting developments in the Hong Kong fund industry. As part of a longstanding Government policy to attract private equity PE and investment fund operations to Hong Kong the Inland Revenue. The Regime operates to provide tax concession at both the salaries tax and profits tax levels.

The introduction of the carried interest tax concession regime under the Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 was a.

Reforms In Hong Kong Encourage Homecoming Of Offshore Funds

Ending Carried Interest Benefit Is One Tax Policy Trump And Clinton Agree On

Carried Interest Tax Concessions Set To Strengthen Hong Kong Sar S Private Equity Industry International Tax Review

Carried Interest Tax Concession Regime Introduced A Pass Corporate Services Hong Kong

Dentons Hong Kong Carried Interest Tax Concessions For Private Equity Fund Operators In Hong Kong Enacted As Law Retrospective Effect From April 2020

Sinema Made Schumer Cut Carried Interest Piece Of Reconciliation Bill

Webcast Hong Kong Tax Concessions On Carried Interest Sanne Group

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

The Tax Treatment Of Carried Interest Aaf

Pwc Cn Publication New Year Good News Carried Interest Tax Concession

Real Estate Private Equity Repe What Is Repe

How Does Carried Interest Work Napkin Finance

Pwc Mainland China And Hong Kong On Twitter On 4 Jan 2021 The Hksar Legislative Council Panel On Financial Affairs Discussed The Legislative Proposals For The Carriedinterest Tax Concession Regime Including A

Carried Interest Tax Concession Regime For Private Equity Funds Lexology

Carried Interest Tax Concession Regime For Private Equity Funds Lexology

Will The Manchin Deal Finally Kill The Carried Interest Loophole The New Yorker

Hong Kong Gazettal Of Bill Providing Tax Concessions For Carried Interest

The Tax Treatment Of Carried Interest Aaf

Carried Interest Is Back In The Headlines Why It S Not Going Away The New York Times