schedule c tax form meaning

If you have a loss check the box that describes your investment in this activity. Form 1041 line 3.

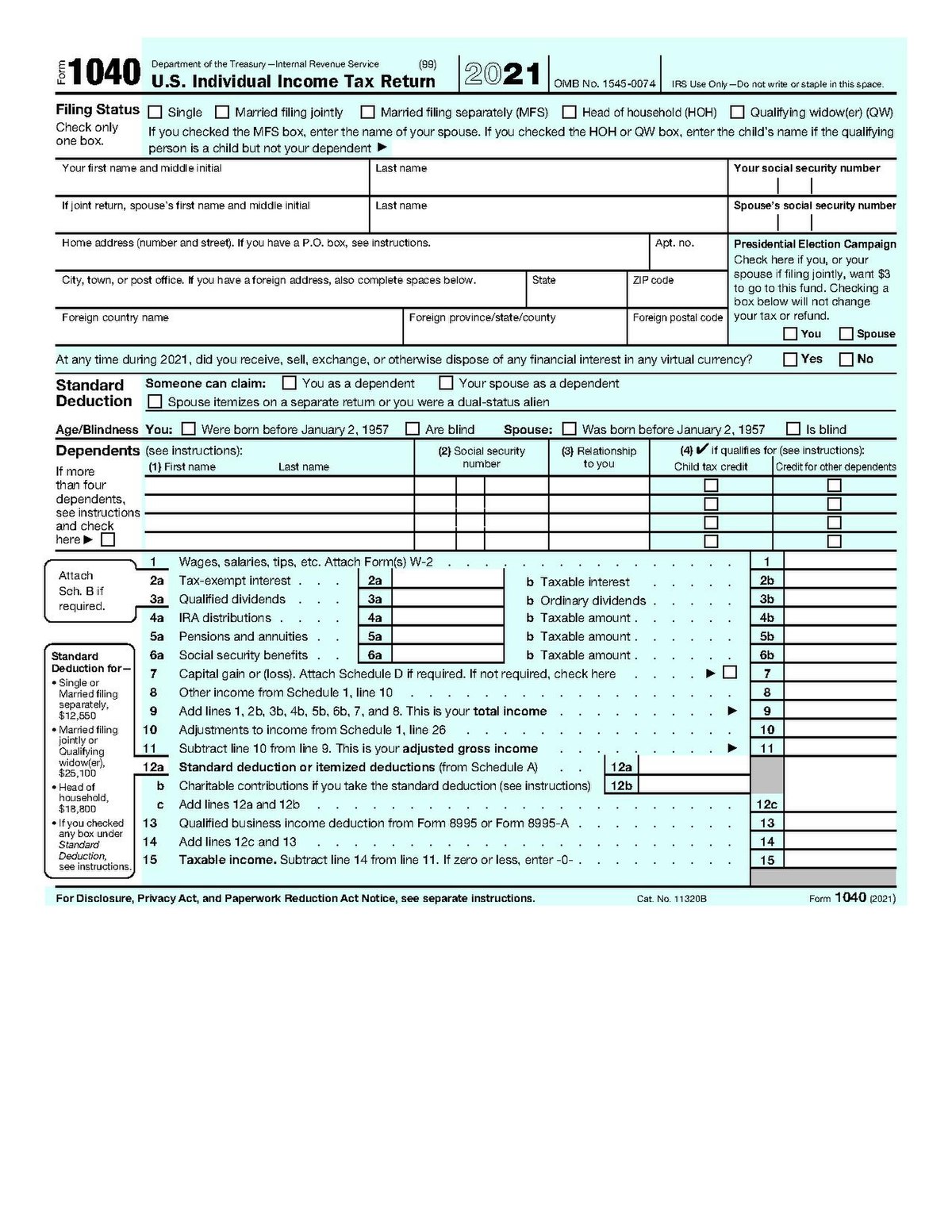

How To Fill Out Your 2021 Schedule C With Example

Income Tax Return for Estates and Trusts.

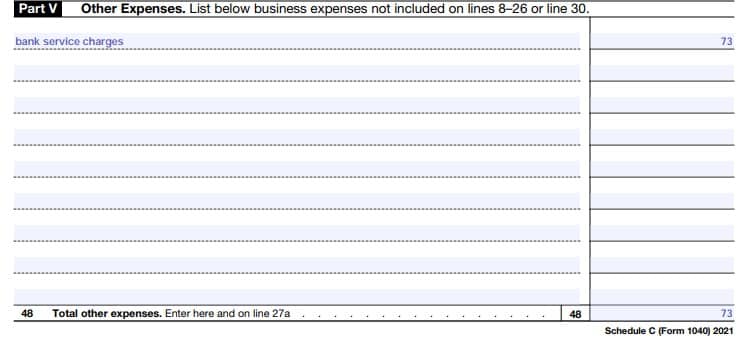

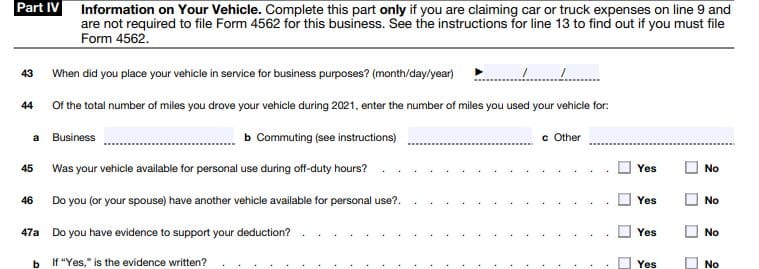

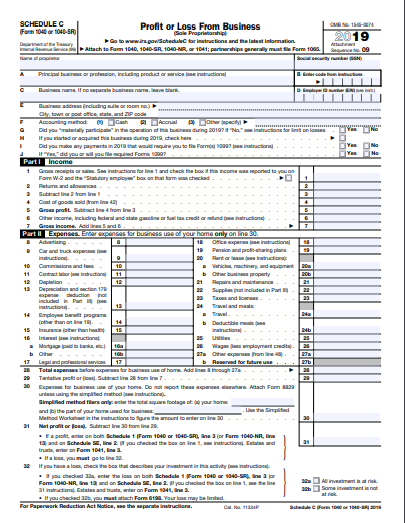

. A tax schedule is a tax form used to make additional calculations or report additional information on a tax return. If you checked 32a enter the. However you can deduct one-half of your self.

The quickest safest and most accurate way to file is by using IRS e-file either online or through a tax. Its part of your individual tax return you just attach it to your 1040 Form at tax time. If you have a loss check the box that describes your investment in this activity.

Its part of the individual tax return IRS form 1040. After your calculation of expenses and income the form will show your profits and. This is where Schedule C starts to look like a tax form rather than a straightforward information document.

About Form 1041 US. A notification form required by the SEC. A Schedule C is one of the most important tax forms to complete for a business owner or sole proprietor.

There are clear instructions in lines 3 5 and 7 but here are the instructions for the. In other words it counts as self-employment income and you do have to pay taxes. Go to line 32 31.

This form lists all relevant information pertaining to a small business issuer of securities including data on its principals location and. Both spouses must also meet one of the IRSs tests for material participationmeaning they actively worked in the business. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040.

That profit or loss is then entered on the owners. Otherwise the business must file Form 1065 like most. You may also need Form 4562 to claim depreciation or Form 8829 to.

Form 1041 line 3. Schedule C of Form 1040 is a tax document that must be filed by those who are self-employed. Schedule C is used by small business owners and professionals who operate as sole proprietors to calculate their profit or loss for the tax year.

Tax schedules generally have several lines on which the taxpayer inputs. Usually people who file a Schedule C Tax Form will also have to file a Schedule SE Tax Form. Schedule C is where you.

Go to line 32 31 32. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. If a loss you.

If a loss you. Information about Schedule C Form 1040 Profit or Loss from Business. Schedule C is typically for people who operate sole proprietorships or single-member LLCs.

The Schedule C form calculates the net profit for independent contractors and small business owners. You will need to file Schedule C annually as an attachment to your Form 1040. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

A Schedule C Form is the way you report any self employed earnings to the IRS. This is where self-employment income from the year is entered and tallied. Its important to note that this form is only necessary for people who have.

Individual Income Tax ReturnLong Form. Up to 10 cash back Form 1040. Schedule C is a tax form used by most unincorporated sole proprietors to report their business income and expenses.

The resulting profit or loss is typically. If you checked 32a enter the. About Form 1099-MISC Miscellaneous.

A Schedule C form is a tax document filed by independent workers in order to report their business earnings.

1120 Calculating Book Income Schedule M 1 And M 3 K1 M1 M3

Business Activity Code For Taxes Fundsnet

1040 2021 Internal Revenue Service

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

How To Fill Out Your 2021 Schedule C With Example

22 Tax Deductions No Itemizing Required On Schedule 1 Don T Mess With Taxes

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

Self Employment Tax Everything You Need To Know Smartasset

How To Read Your 1099 Robinhood

What Is An Irs Schedule C Form Ramsey

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

How To Fill Out Your 2021 Schedule C With Example

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

Business Activity Code For Taxes Fundsnet

:max_bytes(150000):strip_icc()/ScreenShot2021-12-13at3.14.04PM-3d107f1fd8de40ffb793dc8292fedad9.png)

What Is Schedule C Of Form 1040

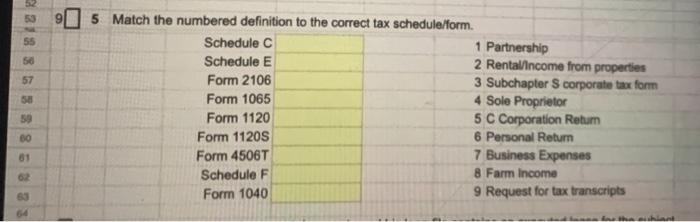

Solved 9 218 8 6 8 8 8 5 5 Match The Numbered Definition To Chegg Com